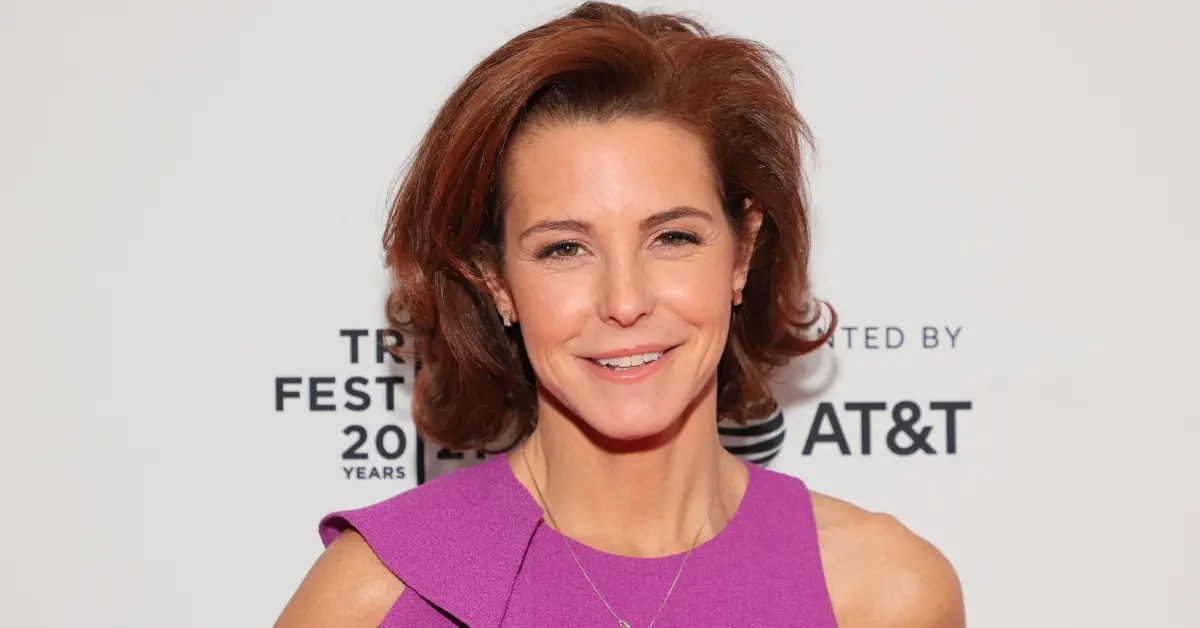

Stephanie Ruhle Salary refers to the financial compensation received by Stephanie Ruhle, a prominent American journalist, host, and news anchor. An example of her salary is her reported annual compensation of $1.5 million while working at MSNBC.

The Stephanie Ruhle Salary holds relevance in the media industry as it reflects the value and recognition accorded to her skills and experience. Her salary, along with that of other notable journalists, serves as a benchmark for industry standards and negotiations.

Throughout her career, Stephanie Ruhle has made significant contributions to the field of journalism, earning recognition for her incisive reporting and commentary. Her salary is a testament to her success and the impact she has had on the media landscape.

Stephanie Ruhle Salary

The essential aspects of Stephanie Ruhle's salary encompass various dimensions, including her compensation structure, negotiation strategies, industry benchmarks, and overall financial management. Each of these aspects plays a crucial role in determining her financial well-being and professional success.

- Compensation Structure

- Negotiation Tactics

- Industry Standards

- Financial Planning

- Tax Implications

- Investment Strategies

- Retirement Planning

- Philanthropy

Stephanie Ruhle's salary not only reflects her expertise and experience but also serves as an indicator of the value placed on journalism in the media industry. Her financial success enables her to make significant contributions to charitable causes and support organizations aligned with her values. Understanding the various aspects of her salary provides insights into the complexities of financial management and the impact it has on an individual's personal and professional life.

| Full Name: | Stephanie Ruhle |

|---|---|

| Date of Birth: | December 24, 1975 |

| Place of Birth: | Park Ridge, New Jersey, U.S. |

| Occupation: | Journalist, Host, News Anchor |

| Net Worth: | $5 million |

| Salary: | $1.5 million per year |

| Education: | Lehigh University (B.A. in International Relations), New York University (M.A. in Public Administration) |

Compensation Structure

Compensation structure is a critical component of Stephanie Ruhle's salary. It outlines the various elements that make up her total compensation package, including base salary, bonuses, incentives, and benefits. The structure of her compensation is designed to attract and retain her as a valuable employee, while also aligning her financial interests with the goals of the organization.

One of the key elements of Stephanie Ruhle's compensation structure is her base salary. This is the fixed amount of money she receives each year, regardless of her performance. Her base salary is negotiated with her employer and is typically based on her experience, skills, and market value. In addition to her base salary, Stephanie Ruhle also receives bonuses and incentives. These variable pay components are typically tied to her performance and the achievement of specific goals. For example, she may receive a bonus for exceeding revenue targets or for successfully launching a new product.

Stephanie Ruhle's compensation structure also includes a variety of benefits, such as health insurance, paid time off, and retirement savings plans. These benefits are designed to provide her with financial security and peace of mind. The overall structure of Stephanie Ruhle's compensation is designed to motivate her to perform at a high level and to contribute to the success of the organization. By understanding the components of her compensation structure, we can gain insights into the factors that influence her financial well-being and professional success.

Negotiation Tactics

Stephanie Ruhle's negotiation tactics play a significant role in determining her salary and overall compensation package. Negotiation is a crucial skill in any professional context, and it is particularly important for high-profile individuals like Stephanie Ruhle who are seeking to maximize their earning potential. Effective negotiation tactics can lead to increased compensation, improved working conditions, and greater job satisfaction.

- Preparation and Research

Stephanie Ruhle's meticulous preparation and thorough research are central to her success in salary negotiations. She gathers data on industry benchmarks, comparable salaries for similar positions, and the financial performance of the organization. This knowledge empowers her to make informed decisions and justify her salary expectations.

- Establishing a Target Salary

Stephanie Ruhle sets a target salary based on her research and a realistic assessment of her worth. She avoids anchoring her expectations too low, while also being mindful of the organization's budget and the overall market conditions. Setting a clear target salary helps her stay focused during negotiations.

- Effective Communication

Stephanie Ruhle is an effective communicator who presents her case clearly and persuasively. She articulates her value proposition, highlights her accomplishments, and explains how her contributions benefit the organization. Her ability to communicate her worth effectively increases her chances of securing a favorable salary.

- Building Relationships

Stephanie Ruhle understands the importance of building strong relationships with key decision-makers. She cultivates relationships with her supervisors, colleagues, and HR representatives. These relationships foster trust and mutual respect, creating a more positive negotiating environment.

Stephanie Ruhle's negotiation tactics are a combination of preparation, research, communication, and relationship-building. By employing these tactics effectively, she has been able to negotiate a salary that reflects her value and contributions to the organization. Her success serves as an example of how effective negotiation can lead to positive outcomes in the workplace.

Industry Standards

Industry standards play a critical role in determining Stephanie Ruhle's salary. These standards provide benchmarks for compensation packages within the media industry, ensuring fairness and consistency. They are established through collective bargaining agreements, industry surveys, and market research, and they consider factors such as experience, skills, job responsibilities, and geographic location.

By adhering to industry standards, organizations can attract and retain top talent like Stephanie Ruhle. They ensure that employees are compensated fairly for their contributions and that the organization remains competitive in the job market. For Stephanie Ruhle, industry standards provide a framework for negotiating her salary and benefits, ensuring that she receives a compensation package commensurate with her value and expertise.

One real-life example of industry standards influencing Stephanie Ruhle's salary is the American Federation of Television and Radio Artists (AFTRA) union contract. This contract sets minimum salary rates for news anchors and hosts, based on factors such as market size and years of experience. By being a member of AFTRA, Stephanie Ruhle benefits from these negotiated standards, which provide a baseline for her salary negotiations.

Understanding the connection between industry standards and Stephanie Ruhle's salary is not only important for her personal financial well-being but also for the broader media landscape. By ensuring that compensation is fair and competitive, industry standards contribute to the stability and growth of the industry. They foster a sense of equity among professionals and help attract and retain the best talent. In turn, this benefits the public by ensuring access to high-quality journalism and media content.

Financial Planning

Financial planning is a critical component of Stephanie Ruhle's salary. It enables her to make informed decisions about how to manage her finances, including her salary, investments, and retirement savings. Effective financial planning helps her maximize her earning potential, achieve her financial goals, and secure her financial future.

One of the key aspects of financial planning for Stephanie Ruhle is budgeting. By creating a budget, she can track her income and expenses, identify areas where she can save money, and make informed decisions about how to allocate her resources. This helps her avoid overspending and ensures that she has sufficient funds to cover her essential expenses, such as housing, food, and transportation. Additionally, financial planning allows Stephanie Ruhle to plan for unexpected events, such as job loss or medical emergencies. By having an emergency fund in place, she can cover unexpected expenses without having to resort to debt or depleting her savings.

Another important aspect of financial planning for Stephanie Ruhle is retirement planning. Given her high income, it is crucial for her to start saving for retirement early on. By contributing to a retirement account, such as a 401(k) or IRA, she can take advantage of tax benefits and grow her savings over time. This will help her secure her financial future and ensure that she has a comfortable retirement.

Overall, financial planning is essential for Stephanie Ruhle to manage her salary effectively and achieve her financial goals. By understanding the connection between financial planning and her salary, she can make informed decisions about how to allocate her resources, plan for the future, and secure her financial well-being.

Tax Implications

Tax implications play a significant role in understanding Stephanie Ruhle's salary. Taxes affect the amount of her salary that she takes home and must be carefully considered in her financial planning. There are several key tax implications that apply to her salary, including:

- Federal Income Tax

Stephanie Ruhle's salary is subject to federal income tax, which is a tax on her taxable income. The amount of tax she owes depends on her income and filing status. The higher her income, the higher her tax liability will be.

- State Income Tax

In addition to federal income tax, Stephanie Ruhle may also be subject to state income tax, depending on the state in which she resides. State income tax rates vary from state to state, so the amount of tax she owes will depend on her state of residence.

- Social Security Tax

Stephanie Ruhle's salary is also subject to Social Security tax, which is a tax that funds Social Security benefits. The Social Security tax rate is 6.2%, and it is deducted from her paycheck before she receives it.

- Medicare Tax

Stephanie Ruhle's salary is also subject to Medicare tax, which is a tax that funds Medicare benefits. The Medicare tax rate is 1.45%, and it is also deducted from her paycheck before she receives it.

These tax implications have a significant impact on Stephanie Ruhle's salary. By understanding the tax implications of her salary, she can make informed decisions about her financial planning and ensure that she is meeting her tax obligations.

Investment Strategies

Investment strategies play a critical role in maximizing the potential of Stephanie Ruhle's salary. By investing her earnings wisely, she can grow her wealth over time and secure her financial future. There are several key investment strategies that she may consider, each with its own potential benefits and risks.

One common investment strategy is diversification. This involves spreading her investments across a variety of asset classes, such as stocks, bonds, and real estate. By diversifying her portfolio, Stephanie Ruhle can reduce her overall risk and improve her chances of achieving long-term growth. Another important investment strategy is asset allocation. This involves determining the appropriate mix of asset classes based on her risk tolerance and investment goals. Stephanie Ruhle should consider her age, time horizon, and financial situation when making asset allocation decisions.

In addition to these general investment strategies, Stephanie Ruhle may also consider specific investment vehicles, such as mutual funds, exchange-traded funds (ETFs), and individual stocks. Each of these vehicles has its own unique characteristics and risks, so it is important for her to carefully research and understand each one before investing. By implementing sound investment strategies, Stephanie Ruhle can maximize the potential of her salary and achieve her financial goals.

Retirement Planning

Retirement planning is a critical aspect of managing Stephanie Ruhle's salary effectively. It involves making strategic financial decisions to ensure a comfortable and secure financial future after she retires from her professional career. Retirement planning encompasses various facets, each playing a vital role in maximizing her retirement savings and ensuring her financial well-being in her later years.

- Investment Strategy

Stephanie Ruhle's investment strategy during her working years will significantly impact her retirement savings. By investing wisely and diversifying her portfolio, she can potentially grow her wealth and generate passive income streams that will support her during retirement.

- Contribution Limits

Understanding the contribution limits for retirement accounts, such as 401(k)s and IRAs, is crucial for Stephanie Ruhle's retirement planning. Maximizing her contributions within these limits allows her to save more for retirement and take advantage of tax benefits.

- Withdrawal Strategies

Developing a withdrawal strategy for retirement is essential to ensure that Stephanie Ruhle's savings last throughout her retirement years. This involves determining how much she can withdraw annually without depleting her savings prematurely and considering factors such as inflation and longevity risk.

- Estate Planning

Estate planning is an important aspect of retirement planning that ensures Stephanie Ruhle's assets are distributed according to her wishes after her passing. This includes creating a will or trust, appointing beneficiaries, and considering tax implications to minimize the impact on her estate.

By carefully considering these facets of retirement planning, Stephanie Ruhle can make informed decisions that will help her accumulate wealth, preserve her savings, and enjoy a financially secure retirement. Retirement planning is an ongoing process that requires regular review and adjustments to ensure it remains aligned with her financial goals and life circumstances.

Philanthropy

Philanthropy plays a significant role in shaping the financial landscape of Stephanie Ruhle's salary. By understanding its various dimensions, we can gain insights into the impact her charitable giving has on her overall financial well-being and legacy.

- Charitable Donations

Stephanie Ruhle's charitable donations are a direct way in which she supports causes and organizations that align with her values and interests. These donations may take the form of monetary contributions, in-kind gifts, or volunteering her time.

- Foundation Creation

Establishing a charitable foundation is a strategic approach to philanthropy that allows Stephanie Ruhle to make a lasting impact. Foundations provide a structured framework for managing and distributing charitable funds, often focusing on specific areas such as education, healthcare, or the arts.

- Social Impact Investing

Social impact investing combines philanthropic goals with financial returns. Stephanie Ruhle may invest in organizations or funds that aim to generate positive social or environmental outcomes alongside financial returns.

- Cause-Related Marketing

Stephanie Ruhle's collaborations with brands or companies that align with her charitable interests represent a form of cause-related marketing. These partnerships can leverage her platform and influence to raise awareness and support for specific causes.

Stephanie Ruhle's philanthropic endeavors demonstrate her commitment to using her financial resources to make a positive impact on society. By understanding the various facets of her philanthropy, we can appreciate the multifaceted role it plays in shaping her overall financial legacy and personal values.

In conclusion, our exploration of Stephanie Ruhle's salary has unveiled the intricate interplay between her financial compensation, strategic planning, and personal values. Key takeaways include the significance of industry standards in shaping her salary, the role of effective negotiation tactics in maximizing her earnings, and the importance of comprehensive financial planning in securing her financial future.

Stephanie Ruhle's philanthropic endeavors demonstrate her commitment to using her financial resources to make a positive impact on society, while her investment strategies highlight the importance of prudent financial management in growing her wealth. Understanding the multifaceted aspects of her salary provides insights into the financial landscape of a successful journalist and media personality.

Ivica Marc: A Basketball Coaching Masterclass

Karl Anderson's Wife: The Ultimate Guide To Support And Influence

Discover The Limitless Storytelling Power Of Myhala

ncG1vNJzZmiumai8rXrSbGWuq12ssrTAjGtlmqWRr7yvrdasZZynnWTAtbHPoZinoZViv7a0y55krJmclr%2B6esetpKU%3D